-

-

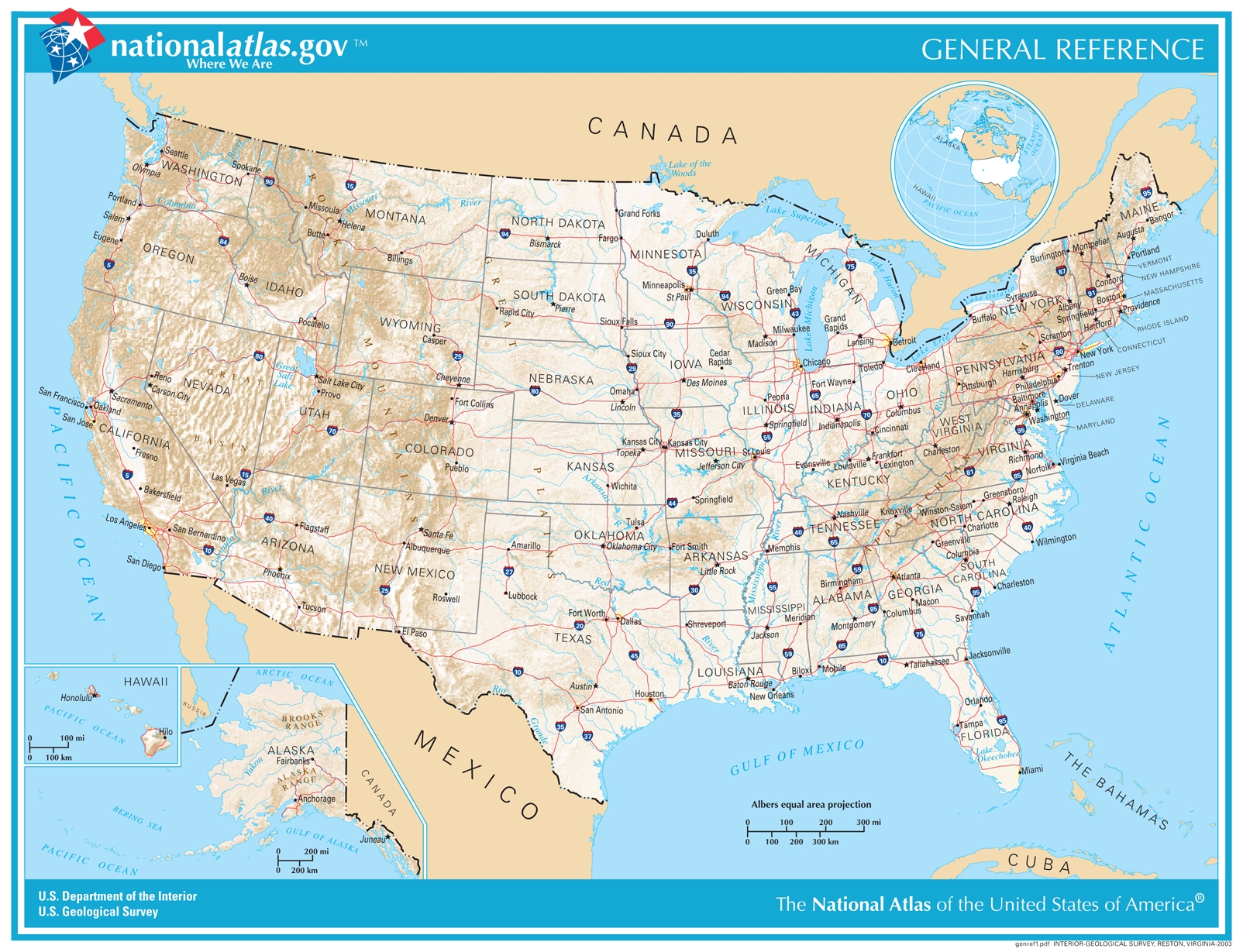

Orange County Real Estate Update...

Read more

-

-

Pricing correctly when your home goes to market is CRUCIAL !...

Read more

-

OR image size is greater than 4 MB)

-

Home Prices Continue to Rise Despite Sales Slowdown...

Read more

-

-

Real Estate News...

Read more

-

-

These days, real estate is the highest appreciating asset- HOME EQUITY ...

Read more

-

-

Summer Time Vibes...

Read more

-

-

Low Housing Inventory Is a Sweet Spot for Sellers...

Read more

-

-

Home Prices set all-TIME HIGHS!...

Read more

-

-

Today’s Housing Inventory Is a Sweet Spot for So-Cal Sellers and a opportunity to take your equity and purchase by cash...

Read more

-

-

Evaluating Your Wants and Needs as a Homebuyer Matters More Today...

Read more

-

-

When will the Federal Reserve drop rates?...

Read more

-

-

Your Needs Matter More Than Today’s Mortgage Rates...

Read more

-

-

Oops! Home Prices Didn’t Crash After All...

Read more

-

-

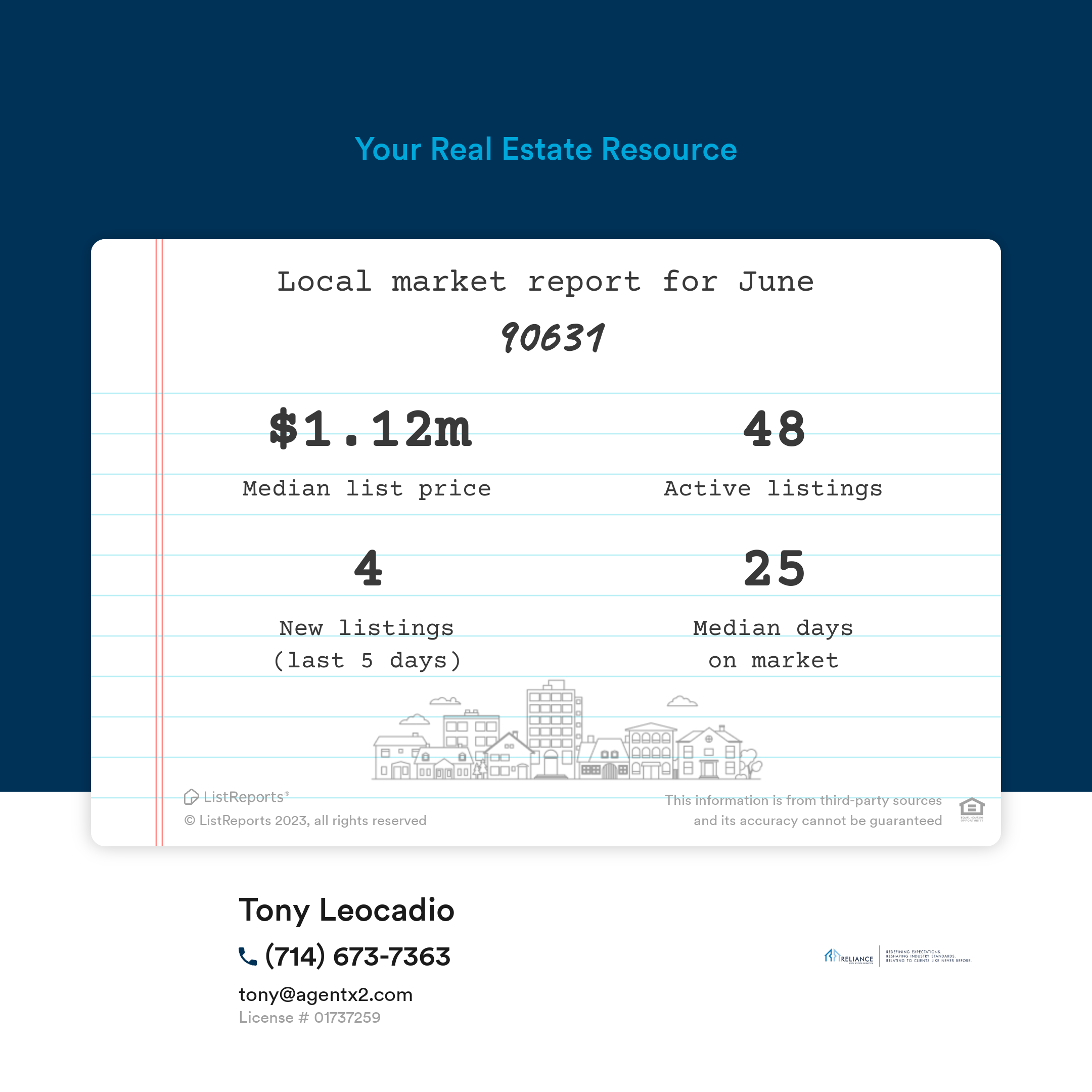

La Habra market report 6-1-2023...

Read more

-

-

Home appreciation is up in Southern California and softening in most other states !...

Read more

-

-

The time is now to sale !...

Read more

-

-

The Benefits of Selling your Southern California Home Now, According to Experts !

Selling at top of market and purchasing in a softened market !...

Read more

-

-

The Impact of Changing Mortgage Rates

...

Read more

-

-

Crazy high rent prices will only go up!...

Read more

-

-

More fees for lower risk borrowers ? Less fees for higher risk borrowers ?

Are they kidding !...

Read more

-

-

What Are the Experts Saying About the Spring Housing Market?...

Read more

-

-

Orange County Housing Summary April 17th 2023...

Read more

-

-

Home Inspections for Sellers: What You Need To Know [INFOGRAPHIC]...

Read more

-

-

Think Twice Before Waiting for Lower Home Prices...

Read more

-

-

Your Tax Refund Can Help You Achieve Your Homebuying Goals...

Read more

-

-

Selling your Home? Why Are You Considering Selling Your

Home in 2023?...

Read more

-

-

REASONS FOR SALING YOUR HOME...

Read more

-

-

Multiple Offers...

Read more

-

-

International investors have a much healthier outlook on American real estate than domestic buyers, a new survey shows....

Read more

-

OR image size is greater than 4 MB)

-

How 3 Recent Bank Failures Could Impact Housing Market...

Read more

-

-

A Smaller Home Could Be Your Best Option...

Read more

-

-

Why It’s Easy To Fall in Love with Homeownership...

Read more

-

-

VALENTINES DAY...

Read more

-

-

Appreciation climbs...

Read more

-

-

The Top Reasons for Selling Your House...

Read more